FHFA Raises Mortgage Loan Limits For 2023

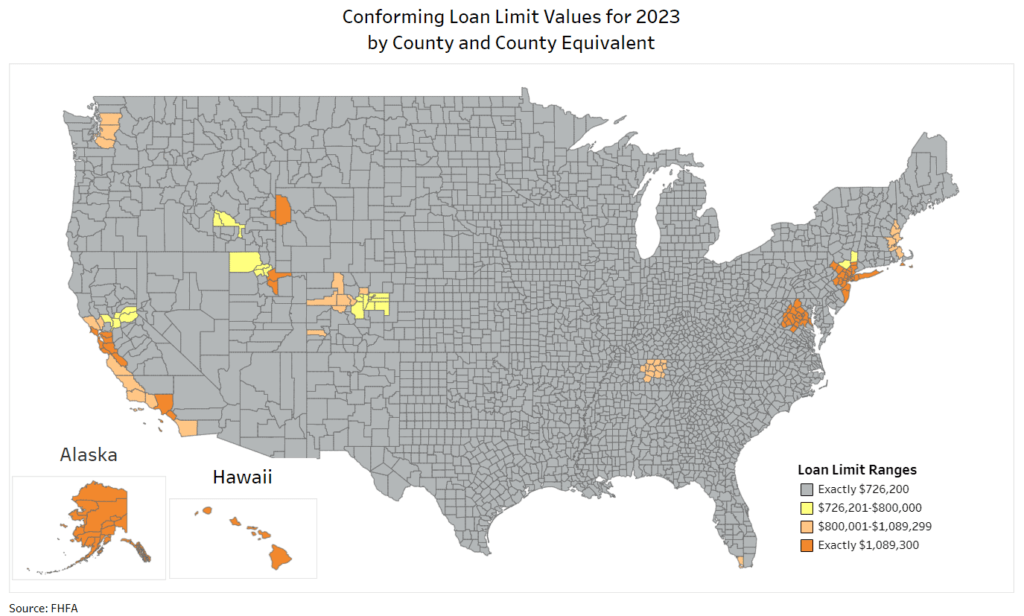

Like last year, the limits are increasing again. Conforming loan limits increased from last year’s $647,200 to $726,200 for 1-unit properties. In high-limit areas like coastal California, the limit is as high as $1,089,300. You can view a map showing the conforming loan limits across the country here. Increasing the conforming loan limit means more …