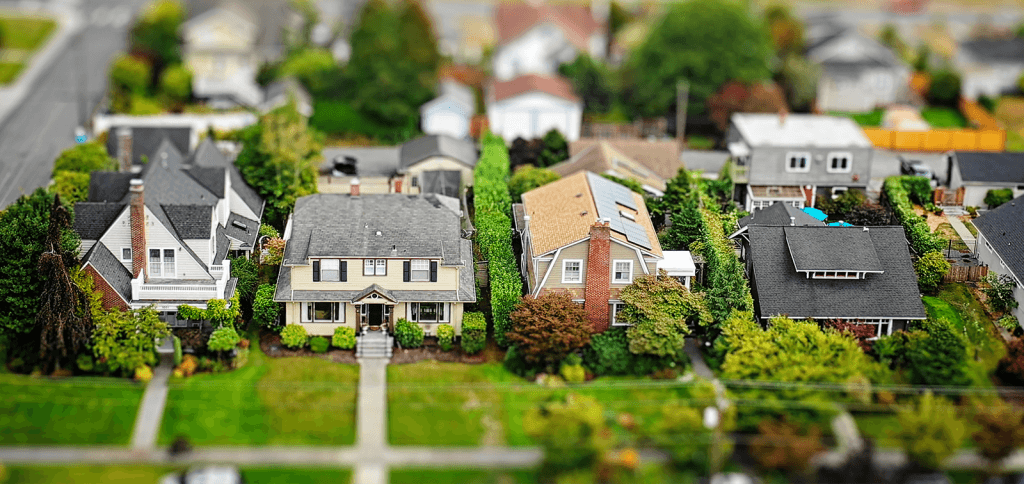

Homebuyers May Get More For Their Money This Winter

With the current housing market’s record-low inventory and all-time-high price tags, waiting for more favorable conditions would seem like the smart move for homebuyers. However, historical data and current trends suggest, however, that shoppers who sign early this winter are likely to get a better deal. According to an article published by Mortgage News Daily analyzing the past 7 …

Homebuyers May Get More For Their Money This Winter Read More »