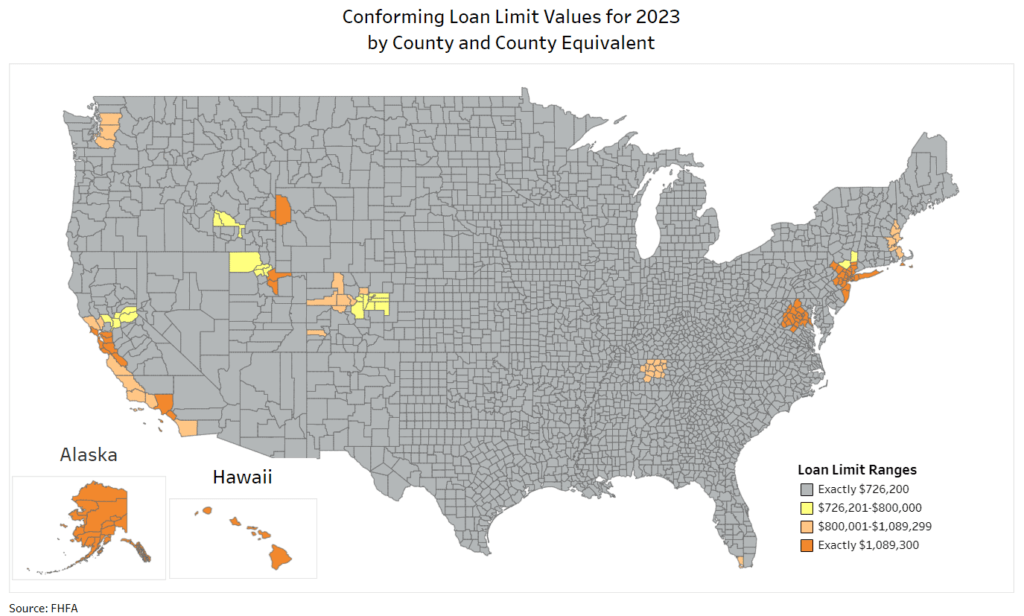

Like last year, the limits are increasing again. Conforming loan limits increased from last year’s $647,200 to $726,200 for 1-unit properties. In high-limit areas like coastal California, the limit is as high as $1,089,300. You can view a map showing the conforming loan limits across the country here. Increasing the conforming loan limit means more homebuyers can apply for conforming mortgages instead of “jumbo” loans, which are typically harder to qualify for.

Conventional loans offer the best confluence of loan terms, down payment, and flexible qualifying. An increasing loan limit expands access to credit to keep pace with increasing property values. For example, a buyer in Los Angeles can now buy for $1,150,000 with just over a 5.0% down payment and obtain a great long-term loan.

Contact us with any questions about the updated loan limits in your area; we’re here to help!